Maximum Sharpe Portfolio

Maximum Sharpe Portfolio or Tangency Portfolio is a portfolio on the efficient frontier at the point where line drawn from the point (0, risk-free rate) is tangent to the efficient frontier.

There is a great discussion about Maximum Sharpe Portfolio or Tangency Portfolio at quadprog optimization question. In general case, finding the Maximum Sharpe Portfolio requires a non-linear solver because we want to find portfolio weights w to maximize w' mu / sqrt( w' V w ) (i.e. Sharpe Ratio is a non-linear function of w). But as discussed in the quadprog optimization question, there are special cases when we can use quadratic solver to find Maximum Sharpe Portfolio. As long as all constraints are homogeneous of degree 0 (i.e. if we multiply w by a number, the constraint is unchanged – for example, w1 > 0 is equivalent to 5*w1 > 5*0), the quadratic solver can be used to find Maximum Sharpe Portfolio or Tangency Portfolio.

I have implemented the logic to find Maximum Sharpe Portfolio or Tangency Portfolio in the max.sharpe.portfolio() function in strategy.r at github. You can specify following 2 parameters:

- Type of portfolio: ‘long-only’, ‘long-short’, or ‘market-neutral’

- Portfolio exposure. For example, ‘long-only’ with exposure = 1, is a fully invested portfolio

Now, let’s construct a sample efficient frontier and plot Maximum Sharpe Portfolio.

###############################################################################

# Load Systematic Investor Toolbox (SIT)

# https://systematicinvestor.wordpress.com/systematic-investor-toolbox/

###############################################################################

setInternet2(TRUE)

con = gzcon(url('http://www.systematicportfolio.com/sit.gz', 'rb'))

source(con)

close(con)

#*****************************************************************

# Create Efficient Frontier

#******************************************************************

# create sample historical input assumptions

ia = aa.test.create.ia()

# create long-only, fully invested efficient frontier

n = ia$n

# 0 <= x.i <= 1

constraints = new.constraints(n, lb = 0, ub = 1)

constraints = add.constraints(diag(n), type='>=', b=0, constraints)

constraints = add.constraints(diag(n), type='<=', b=1, constraints)

# SUM x.i = 1

constraints = add.constraints(rep(1, n), 1, type = '=', constraints)

# create efficient frontier

ef = portopt(ia, constraints, 50, 'Efficient Frontier')

#*****************************************************************

# Create Plot

#******************************************************************

# plot efficient frontier

plot.ef(ia, list(ef), transition.map=F)

# find maximum sharpe portfolio

max(portfolio.return(ef$weight,ia) / portfolio.risk(ef$weight,ia))

# plot minimum variance portfolio

weight = min.var.portfolio(ia,constraints)

points(100 * portfolio.risk(weight,ia), 100 * portfolio.return(weight,ia), pch=15, col='red')

portfolio.return(weight,ia) / portfolio.risk(weight,ia)

# plot maximum Sharpe or tangency portfolio

weight = max.sharpe.portfolio()(ia,constraints)

points(100 * portfolio.risk(weight,ia), 100 * portfolio.return(weight,ia), pch=15, col='orange')

portfolio.return(weight,ia) / portfolio.risk(weight,ia)

plota.legend('Minimum Variance,Maximum Sharpe','red,orange', x='topright')

Now let’s see how to construct ‘long-only’, ‘long-short’, or ‘market-neutral’ Maximum Sharpe Portfolio or Tangency Portfolios:

#*****************************************************************

# Examples of Maximum Sharpe or Tangency portfolios construction

#******************************************************************

weight = max.sharpe.portfolio('long-only')(ia,constraints)

round(weight,2)

round(c(sum(weight[weight<0]), sum(weight[weight>0])),2)

weight = max.sharpe.portfolio('long-short')(ia,constraints)

round(weight,2)

round(c(sum(weight[weight<0]), sum(weight[weight>0])),2)

weight = max.sharpe.portfolio('market-neutral')(ia,constraints)

round(weight,2)

round(c(sum(weight[weight<0]), sum(weight[weight>0])),2)

The long-only Maximum Sharpe portfolio as expected has exposure of 100%. The long-short Maximum Sharpe portfolio is 227% long and 127% short. The market-neutral Maximum Sharpe portfolio is 100% long and 100% short.

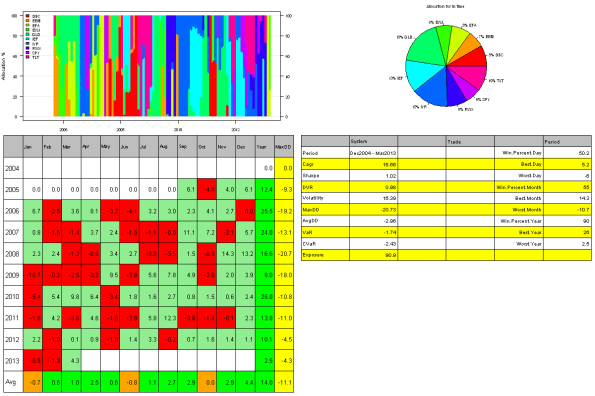

As the last step, I run Maximum Sharpe algo vs other portfolio optimization methods I have previously discussed (i.e. Risk Parity, Minimum Variance, Maximum Diversification, Minimum Correlation) on the 10 asset universe used in the Adaptive Asset Allocation post.

#*****************************************************************

# Load historical data

#******************************************************************

load.packages('quantmod')

tickers = spl('SPY,EFA,EWJ,EEM,IYR,RWX,IEF,TLT,DBC,GLD')

data <- new.env()

getSymbols(tickers, src = 'yahoo', from = '1980-01-01', env = data, auto.assign = T)

for(i in ls(data)) data[[i]] = adjustOHLC(data[[i]], use.Adjusted=T)

bt.prep(data, align='keep.all', dates='2004:12::')

#*****************************************************************

# Code Strategies

#******************************************************************

prices = data$prices

n = ncol(prices)

models = list()

#*****************************************************************

# Code Strategies

#******************************************************************

# find period ends

period.ends = endpoints(prices, 'months')

period.ends = period.ends[period.ends > 0]

n.mom = 180

n.vol = 60

n.top = 4

momentum = prices / mlag(prices, n.mom)

obj = portfolio.allocation.helper(data$prices, period.ends=period.ends,

lookback.len = n.vol, universe = ntop(momentum[period.ends,], n.top) > 0,

min.risk.fns = list(EW=equal.weight.portfolio,

RP=risk.parity.portfolio,

MV=min.var.portfolio,

MD=max.div.portfolio,

MC=min.corr.portfolio,

MC2=min.corr2.portfolio,

MCE=min.corr.excel.portfolio,

MS=max.sharpe.portfolio())

)

models = create.strategies(obj, data)$models

#*****************************************************************

# Create Report

#******************************************************************

strategy.performance.snapshoot(models, T)

plotbt.custom.report.part2(models$MS)

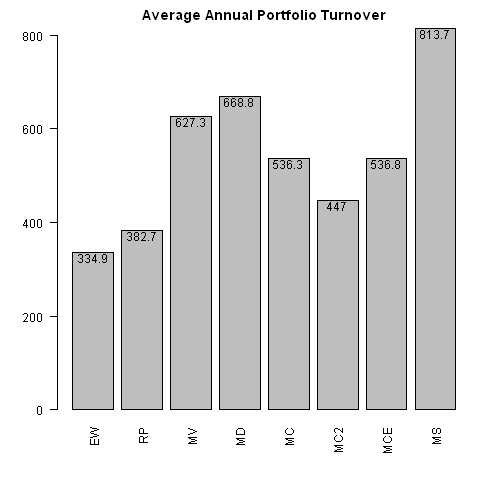

# Plot Portfolio Turnover for each strategy

layout(1)

barplot.with.labels(sapply(models, compute.turnover, data), 'Average Annual Portfolio Turnover')

The allocation using Maximum Sharpe Portfolio produced more concentrated portfolios with higher total return, higher Sharpe ratio, and higher turnover.

Thanks Michael again for this.

I was trying to get the trades list by adding the below command without success:

plotbt.custom.report.part3(models$MS, trade.summary = TRUE).

Any help would be very appreciated.

Mohamed,

to get list af all trades write: tradelist = bt.trade.summary(data,models$yourmodel)

Michael,

Quick question – What are you using as your starting point: 0,0 or the risk free rate x%,0?

Thanks,

Currently I’m using (0,0)

Hello,

Has anyone tried testing the following; instead of picking the top 4, picking the top 3 and the bottom one as per their momentum in a long-short setup of say 120/20.

Sorry to be frozen like a deer in the headlights when it comes to R.

Thanks.

Is is safe to say that starting from say 1%,0 would push up risk AND return?

Using risk free rate > 0% will push risk and return up for the Maximum Sharpe portfolio

Question:

1. How do I change the risk free rate to be something other than (0, 0)

2. How do I create the efficient frontier to be long short (and not just long only)

Thanks for your great work.